Stock analysis that used to take hours takes only seconds to complete with AI

So I’m happy to report about the new AI capabilities offered by the Google Finance website. There are two types of major financial analysis used to predict stock price movement. One is called fundamental and it uses data like earnings, price-earnings ratios, and other economic data to help you decide whether a stock is cheap or expensive; roughly, if a stock is changing hands at a price that is cheaper than your analysis says it should be trading at, it’s a buy. If it is trading above that price, it would be a sell.

The other type of analysis is technical analysis. This is the art of forecasting future stock movement by looking at current and past stock activity. This form of analysis covers the use of charts and patterns to help you decide which stocks and options to buy. In theory, you should be able to cover up the name of a stock, look at the pattern, and make an investment decision. With the latest version of Google Finance, you can use AI to ask questions about future events and plug the answers into your models.

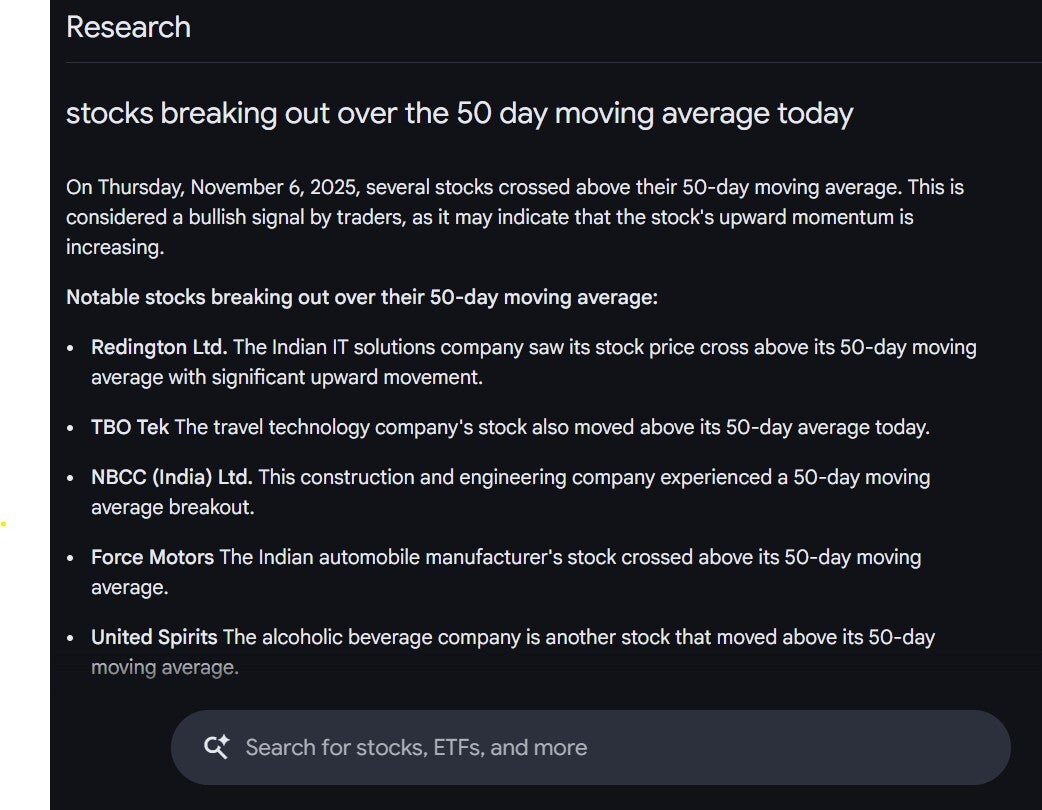

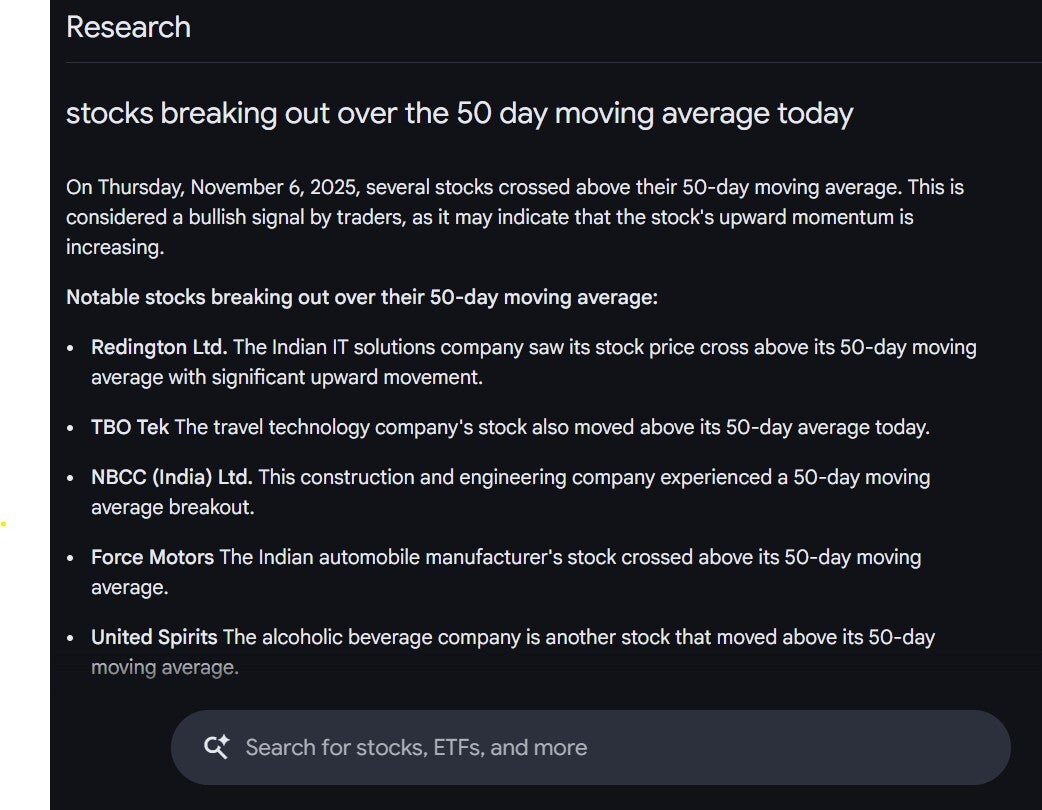

Asking AI for stocks that broke out above their 50-day moving average; a task that used to take hours now takes only seconds to complete. | Image credit-PhoneArena

AI also saves technicians from having to spend hours poring over their charts. With the AI on Google Finance all you have to do is type in the search bar asking for stocks that crossed over their 50-day moving average today and you get a list of those shares that might have broken out enroute to huge future gains.

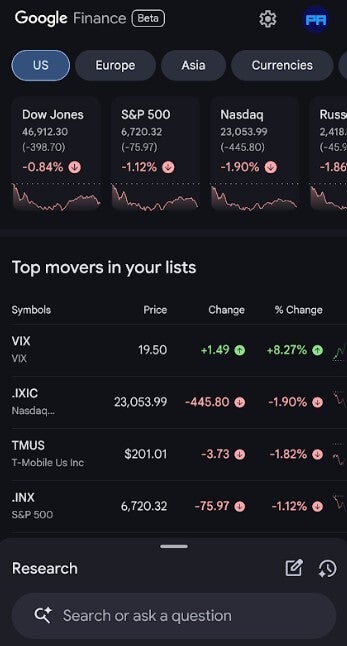

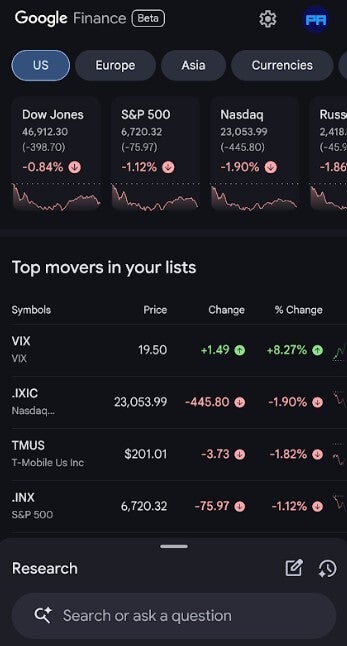

What the improved Google Finance website looks like on a mobile browser. | Image credit-PhoneArena

Get analyst reactions to earnings releases right away

We often see huge moves in stock prices right after a quarterly earnings report is released. Just last week, Google added a new feature to the site that will keep you up-to-date about earnings releases. Google Finance now features an “Upcoming earnings” calendar in the center panel. Or you can tap on a stock symbol from your watchlist. The new earnings tab will show you when companies you’re interested in will hold their next earnings release and conference call.

Missing what the executives of companies you invest in are saying during these calls can cost you money. Even more exciting, if there is a call in progress, you can listen to the live audio stream with a real-time transcript that can be viewed during the call and after the call is over. This puts you on level ground with Wall Street traders and analysts. Additionally, AI-based comments will be updated before, during, and after the call under “At a glance.” You’ll see the latest news reports and analyst reactions as they are disseminated. Time is money and that makes Google Finance potentially worth a fortune.

You’ll have access to the same data that hedge funds use

You will have access to the same data that the hedge fund bros are using to make their trading decisions. How did the latest quarter perform compared to previous quarters? More importantly, how did the latest quarter do against the expectations of Wall Street analysts? The company you invested in might have bled so much red ink this quarter that the company is being called “Carrie.” But if those numbers beat expectations, you could make some money from your long position after all.